georgia ad valorem tax refund

Get started Youll need your VIN. ST-12 ST-12A ST-12B ST-12 Claim for.

![]()

Georgia New Car Sales Tax Calculator

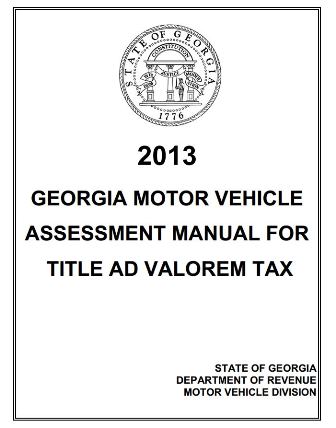

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

. Local state and federal government websites often end in gov. The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. Georgia ad valorem tax refund Monday August 29 2022 Local state and federal government websites often end in gov.

Track a Tax Refund. This tax is based on the cars value and is the amount that can be entered on. Vehicles purchased on or after March 1 2013 and titled in Georgia.

The Georgia Department of Revenue DOR provides answers to additional questions on the title ad valorem tax on its website. The basis for ad valorem taxation is the fair market value of. Use Ad Valorem Tax Calculator Pay Annual Ad Valorem.

These forms are for claims for refunds of sales tax use tax 911 Prepaid Wireless Charges State Hotel-Motel Fees and Transportation Services Tax. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019.

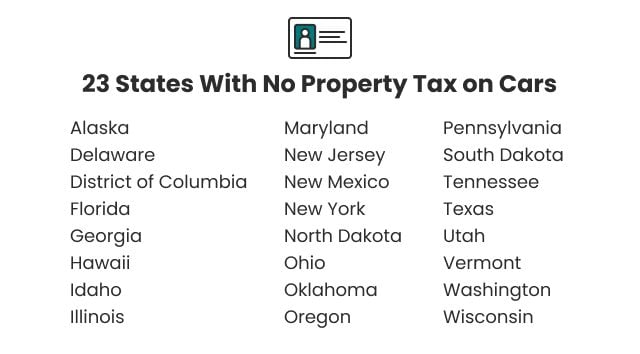

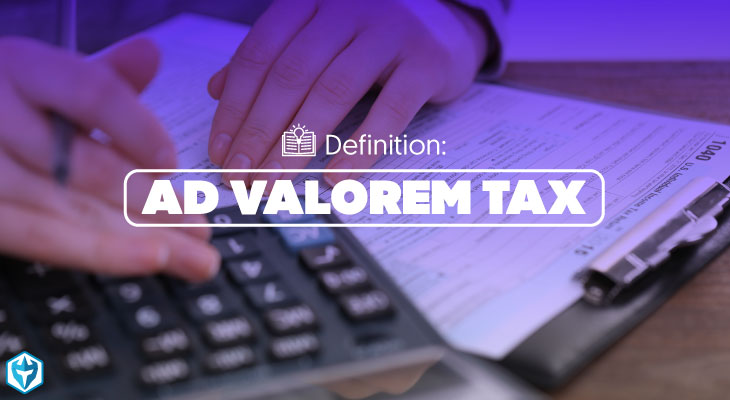

Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. Instead it appears to be a tax in the nature of a sales tax. Ad valorem tax is computed by multiplying the State-assessed value by the local millage rate.

The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Ad Valorem Tax Refunds If a taxpayer discovers they have paid taxes that they believe were illegal or erroneous they may request a refund within 3 years of the date of payment. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a.

If purchased on or after March 1 2013 then see Title Ad Valorem Tax TAVT for instructions. For tax year 2018 Georgias TAVT rate is 7 prtvrny. Ad valorem tax more commonly known as property tax is a large source of revenue for local government in Georgia.

Updated April 6 2021 For the answer to this question we consulted the Georgia Department of Revenue. December 18 2019 In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax. The basis for ad valorem taxation.

General Information on Georgia Ad Valorem Taxes Tax Year Statewide Uniform The Georgia real estate tax year runs on a calendar year basis ie. You can deduct only the Ad Valorem Tax portion of the annual auto registration on your Federal Schedule A. From January 1st through December.

You will now pay this one-time. March 17 2021 513 PM. No it is not deductible For vehicles purchased in or transferred to Georgia in 2012 and after there is a title tax.

Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. As an example if the fair market value of a used vehicle in Georgia is 14000 the TAVT that the owner of the. It is assessed at the time of purchase on a one time basis.

Vehicles purchased on or after March 1 2013 and. PT-472NS Non-Resident Service Members. MV-33 - Georgia Department of Revenue DOR Title Ad Valorem.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. Ad Valorem taxes are assessed based on the value of.

Deducting Property Taxes H R Block

618 Property Tax Icon Illustrations Clip Art Istock

Get Paid To Complete Offers At Treasuretrooper Com Offer Completed Paying

Property Taxes Calculating State Differences How To Pay

German Rental Income Tax How Much Property Tax Do I Have To Pay

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Tax Form W 2 Worksheet W2 Lesson Plan Teaching Taxes

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

What You Need To Know About Condo Property Tax

An Independent Contractor Who Receives 1099 Misc Forms Instead Of W 2s May Want A Second Pair Of Eyes On Their Returns Tax Write Offs Tax Prep Tax Preparation

2021 Property Tax Bills Sent Out Cobb County Georgia

What Is A Homestead Exemption And How Does It Work Lendingtree

Learn More About Georgia Property Tax H R Block

Georgia Title Ad Valorem Tax Updated Youtube

Types Of Taxes Income Property Goods Services Federal State

Ad Valorem Tax Definition Day Trading Terminology Warrior Trading

Free Standard Rental Agreement Form Printable Real Estate Forms Real Estate Forms Real Estate Lease Rental Agreement Templates

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes